42 step up coupon bonds

Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Dual Coupon Bond - Fincyclopedia For instance, a bond may pay 6% interest for the next five years, and thereafter interest payment increases by an additional 2% every next five years until the bond matures. Typically, issuers embed dual-coupon bonds with call options which give them the right to redeem the bonds at par on the date the coupon is set to step up.

Step-Up Bonds Definition & Beispiel | - 2022 - Finanzwörterbuch A Step-up-bond ist eine Anleihe mit einem Kupon das erhöht sich ("steigt"), normalerweise in regelmäßigen Abständen, während die Anleihe ausstehend ist. Step-up-Bonds werden oft von Regierungsbehörden ausgegeben. ... dass ihre Step-Up-Anleihen aufgerufen werden, es sei denn, die Zinssätze steigen höher und schneller als der Coupon-Satz ...

Step up coupon bonds

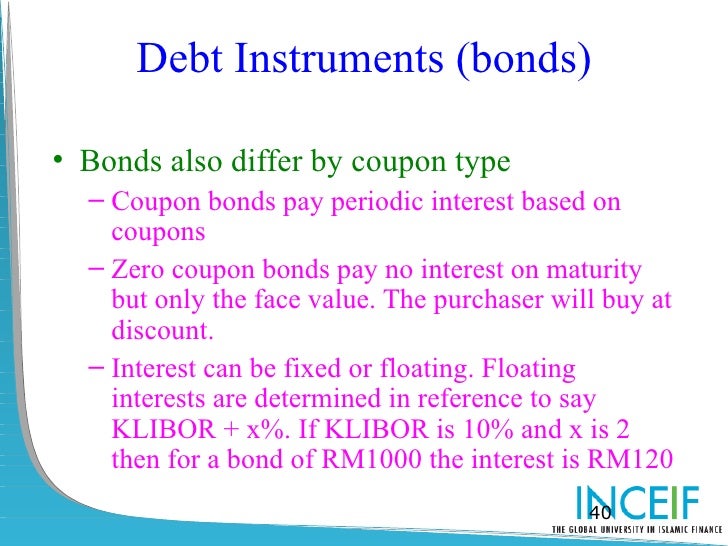

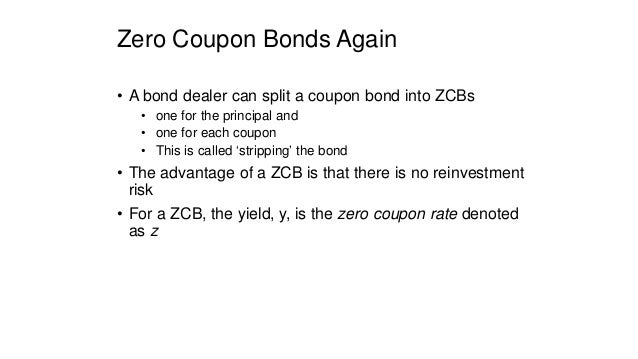

An Overview of Perpetual Bonds - Investopedia As an example, a bond with a $100 par value, paying a coupon rate of 5%, ... some perpetual bonds boast "step-up" features that increase the interest payment at predetermined points in the ... Step Up Coupon Bond Calculator bond step calculator up coupon. April-May and September-October are some of the best times to go, as November-March brings lots of tourists from North America escaping the gold, and June-August brings Australians looking for winter sun. starry night lights coupon. Stove Top Stuffing Coupons November 2015 Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Step up coupon bonds. International bonds: Freddie Mac, 1% 28jun2019, USD(step-up) US3134G9TU18 Issue Information International bonds Freddie Mac, 1% 28jun2019, USD(step-up). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings Protecting investors from interest-rate risk with step-up bonds The step-up bonds may have a single interest rate rise or multiple interest rate rises. However, the increases of the bond's coupon rates and their step-up dates are predefined by the issuer at the start. Some step-up bonds allow for an adjustment of the interest rate to the inflation rate. Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred Coupon bonds help businesses acquire finance without paying periodic interest. A lump-sum is paid including interest at the time of maturity. ... a company paying 4% interest on step-up bonds defers interest payments till maturity. On maturity, the company will pay interest at an increased rate (say) 5.5% for all the deferred periods. ... Dude, Where's My Coupon Step-Up? - 9fin.com Today (13 September 2021) marks the launch of a €450 million sustainability-linked bond offering to finance Stirling Square's acquisition of Itelyum, an Italian waste management company. The bonds feature a novel sustainability-linked redemption premium step-up, which is new to the European high yield market. As the market kicks back into ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ... Astrea 7 Bonds: 10 Things Investors Need To Know About This Private ... For retail investors, if the Class A-1 or Class B bonds are not redeemed by their respective scheduled dates in 5 years, there will be a one-time 1% step-up in interest rates. This means the Class A-1 bonds will have an annual interest rate of 5.125%, while the Class B bonds will have an annual interest rate of 7.0%. Step-Up Bond - Definition, Understanding, and Why Step-Up Bond is ... A step-up bond is a security that has a coupon rate which increases with time. A step-up bond typically performs better than any other fixed-rate investment in a rising rate market. The Securities and Exchange Commission (SEC) regulates the step-up bonds. Step-up bonds tend to have lower coupon rates or interest rates initially since they have ... Step-Up Notes Offer Higher Yields Than Cash - Barbara Friedberg Step up notes are a type of bond with credit ratings from AAA on down to C. According to Investopedia, "A Step-up Bond pays an initial coupon rate for the first period, and then a higher coupon rate for the following periods. For example a five year bond may pay a 4% coupon for the first two years of its life and a 6% coupon for the next ...

Domestic bonds: Freddie Mac, 1% 30jun2021, USD(step-up) US3134G9D795 Issue Information Domestic bonds Freddie Mac, 1% 30jun2021, USD(step-up). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings Half of sustainability-linked bond issuers see greenium larger than ... A coupon step-up of 25bp remained the standard, according to the report, with 45% of issuers committing to pay up a quarter of a percent if they missed their sustainability targets. The second most common step-ups were 12.5bp at 23% and 50bp at 11%. Deroux said that a 25bp step up "seems insufficient". Fixed Income News | Fidelity Investments If the municipality wants to issue 30-year bonds callable at par in year 10, the market will set the coupon to 3.50%, i.e. 50 basis points above the 3% coupon of the optionless bond. The combined cashflows of the 3.50% callable bond and the 2.61% refunding bond will be the same as that of the step-up coupon bond. Clearly the issuer should ... Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Quant Bonds - Coupons The coupon for this bond is 6% and you would receive two payments a year of $30, assuming payments are made semi-annually. ... Variable Coupons Stepped Coupon. Also known as Step Up The interest rates increase (or step up) The coupon increases during the life of the bond They are callable at each step-up. Deferred Coupons.

Bonds A Step Step Analysis With Excel Chapter 1 These are also called as a dual coupon or multiple coupon bonds. Step Down Bonds Surety bonds Surety bonds help small businesses win contracts by providing the customer with a guarantee that the work will be completed. Many public and private contracts require surety bonds, which are offered by surety companies. Discounted Cash Flow - Create ...

Calling munis is too pricey | Bond Buyer The combined cashflows of the 3.50% callable bond and the 2.61% refunding bond will be the same as that of the step-up coupon bond. Clearly the issuer should prefer the 3% optionless bond to the 3 ...

Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds, Benefits-Risks Meaning & Definition. Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Russia Bans Coupon Payment to Foreigners on $29 Billion in Bonds The Russian central bank has banned coupon payments to foreign owners of ruble bonds known as OFZs in what it called a temporary step to shore up markets in the wake of international sanctions.

Callable Bond - Definition, How It Works, and How to Value The callable bond is a bond with an embedded call option. These bonds generally come with certain restrictions on the call option. For example, the bonds may not be able to be redeemed in a specified initial period of their lifespan. In addition, some bonds allow the redemption of the bonds only in the case of some extraordinary events.

Step-Up CDs: What They Are And How They Work | Bankrate U.S. Bank, for instance, offers a 28-month step-up CD. The interest rate tied to the CD increases every seven months, moving from 0.05 percent to 0.25 percent to 0.45 percent to 0.65 percent. But ...

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Difference Between Coupon Rate and Interest Rate Firstly, it is the zero-coupon bonds. They don't have any coupon payment for the bondholder to pay for. Also, it is affordable by the holder at a price lesser than the original par value of the bond. Secondly, Step-Up notes, unlike the true definition of a coupon rate, tend to increase the rate at a set period.

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs A zero-coupon bond is a preferred investment option since it is secured, especially if invested for the long term. Some of the benefits that these offers are: Predictable Returns: Since returns on zero-coupon bonds are the difference between maturity/face value and discounted face value, investors can predict returns on a zero-coupon bond. Low ...

What Is a Step-up Bond? - The Balance A step-up bond is a bond that increases its fixed interest payments during its life according to a predetermined schedule. One of the main appeals of investing in bonds is that they typically offer fixed interest payments known as coupons. But investors could miss out on the opportunity to earn more money if interest rates rise before the bond ...

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Step Up Coupon Bond Calculator bond step calculator up coupon. April-May and September-October are some of the best times to go, as November-March brings lots of tourists from North America escaping the gold, and June-August brings Australians looking for winter sun. starry night lights coupon. Stove Top Stuffing Coupons November 2015

An Overview of Perpetual Bonds - Investopedia As an example, a bond with a $100 par value, paying a coupon rate of 5%, ... some perpetual bonds boast "step-up" features that increase the interest payment at predetermined points in the ...

Post a Comment for "42 step up coupon bonds"