45 calculate coupon rate in excel

Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1 Coupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

:max_bytes(150000):strip_icc()/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Calculate coupon rate in excel

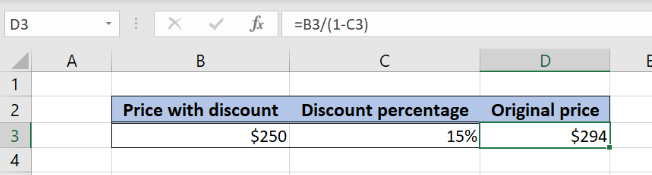

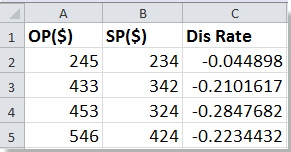

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Using Excel formulas to figure out payments and savings Using the function PMT (rate,NPER,PV) =PMT (5%/12,30*12,180000) the result is a monthly payment (not including insurance and taxes) of $966.28. The rate argument is 5% divided by the 12 months in a year. The NPER argument is 30*12 for a 30 year mortgage with 12 monthly payments made each year. How to calculate discount rate or price in Excel? - ExtendOffice Select a blank cell, for instance, the Cell C2, type this formula =A2- (B2*A2) (the Cell A2 indicates the original price, and the Cell B2 stands the discount rate of the item, you can change them as you need), press Enter button and drag the fill handle to fill the range you need, and the sales prices have been calculated. See screenshot:

Calculate coupon rate in excel. How to calculate bond price in Excel? - ExtendOffice Select the cell you will place the calculated price at, type the formula =PV (B20/2,B22,B19*B23/2,B19), and press the Enter key. Note: In above formula, B20 is the annual interest rate, B22 is the number of actual periods, B19*B23/2 gets the coupon, B19 is the face value, and you can change them as you need. Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% Calculate a Forward Rate in Excel - Investopedia This can be otherwise written as "= (100 x 1.04)" in Excel. It should produce $104. The final two-year value involves three multiplications: the initial investment, interest rate for the first year...

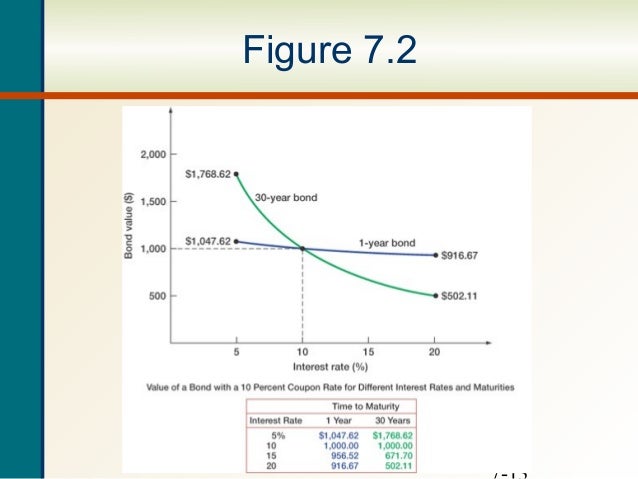

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments... Zero-Coupon Bond: Formula and Calculator [Excel Template] If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return.

Coupon Rate Template - Free Excel Template Download C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Excel Modeling Templates PowerPoint Presentation Templates Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100 3 Ideal Examples to Calculate Coupon Rate in Excel How to Calculate Bond Yield in Excel: 7 Steps (with Pictures) - wikiHow Skipping cell A9, type "Value of Bond" in cell A10. Skip cell A11, and type "Bond Yield Calculations" in cell A12, "Current Yield" in cell A13, "Yield to Maturity" in cell A14 and "Yield to Call" in cell A15. 2. Format the column width. Move the mouse pointer over the line separating columns A and B, just above the Bond Yield Data column heading.

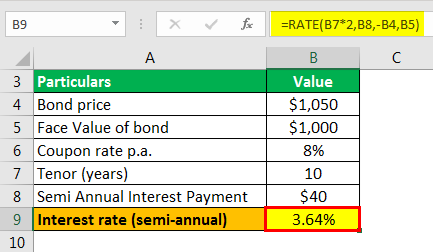

How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2.

› ask › answersHow Do I Calculate a Discount Rate Over Time Using Excel? May 20, 2022 · Learn how to calculate the discount rate in Microsoft Excel and what the discount factor is. Discover how the discount rate and discount factor compare.

How to Calculate Discount in Excel: Examples and Formulas In detail, the steps to write the calculation process of the discounted price in excel are as follows: Type the equal sign ( = ) in the cell where you want to place the discounted value Input the original price or the cell coordinate where the number is after =. Then, type in a minus sign ( - )

How can I calculate a bond's coupon rate in Excel? How to Find the Coupon Rate. In Excel, enter the coupon fee in cell A1. In cell A2, enter the variety of coupon funds you obtain annually. If the bond pays curiosity as soon as a yr, enter 1. If you obtain funds semi-annually, enter 2. Enter four for a bond that pays quarterly. In cell A3, enter the method =A1x A2 to yield the entire annual ...

Calculating Accrued Interest on a Bond in Excel | Example - XPLAIND.com ACCRINT is the Excel function that calculates the interest accrued on a bond between two coupon dates. ACCRINT calculates accrued interest by multiplying the coupon rate with the face value of the bond and the number of days between the issue date or the last coupon date and the settlement date and dividing the resulting figure by the total days in a coupon payment.

How to calculate Spot Rates, Forward Rates & YTM in EXCEL The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond ).

How to Calculate Commissions in Excel with VLOOKUP The job of the VLOOKUP is to find the rep's sales amount in the rate table, and return the corresponding payout rate. For this example our commissions plan looks like the following: Rep sells $0-$50,000, they earn 5%. Rep sells $51,000-$100,000, they earn 7%. Rep sells $100,001-$150,000, they earn 10%. Rep sells over $150,001, they earn 15%.

Calculate the Interest or Coupon Payment and Coupon Rate of a Bond ... Microsoft Office Excel: Calculate the Interest or Coupon Payment and Coupon Rate of a Bond: 4:50: Microsoft Office Excel: Calculate the Length (Years to Maturity) and Number of Periods for a Bond: 5:04: Microsoft Office Excel: Calculate the Present Value of a Bond with Semiannual or Quarterly Interest Payments: 12:56: Microsoft Office Excel

How to Calculate Bond Price in Excel (4 Simple Ways) In the formula, rate = F8, nper = F7, pmt = F5*F9, [fv] = F5. 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9/2,K5) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5.

Using RATE function in Excel to calculate interest rate - Ablebits.com The RATE function in Excel can also be used for calculating the compound annual growth rate (CAGR) on an investment over a given period of time. Supposing you want to invest $100,000 for 5 years and receive $200,000 in the end. How will your investment grow in terms of CAGR?

How to calculate discount rate or price in Excel? - ExtendOffice Select a blank cell, for instance, the Cell C2, type this formula =A2- (B2*A2) (the Cell A2 indicates the original price, and the Cell B2 stands the discount rate of the item, you can change them as you need), press Enter button and drag the fill handle to fill the range you need, and the sales prices have been calculated. See screenshot:

Using Excel formulas to figure out payments and savings Using the function PMT (rate,NPER,PV) =PMT (5%/12,30*12,180000) the result is a monthly payment (not including insurance and taxes) of $966.28. The rate argument is 5% divided by the 12 months in a year. The NPER argument is 30*12 for a 30 year mortgage with 12 monthly payments made each year.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Post a Comment for "45 calculate coupon rate in excel"