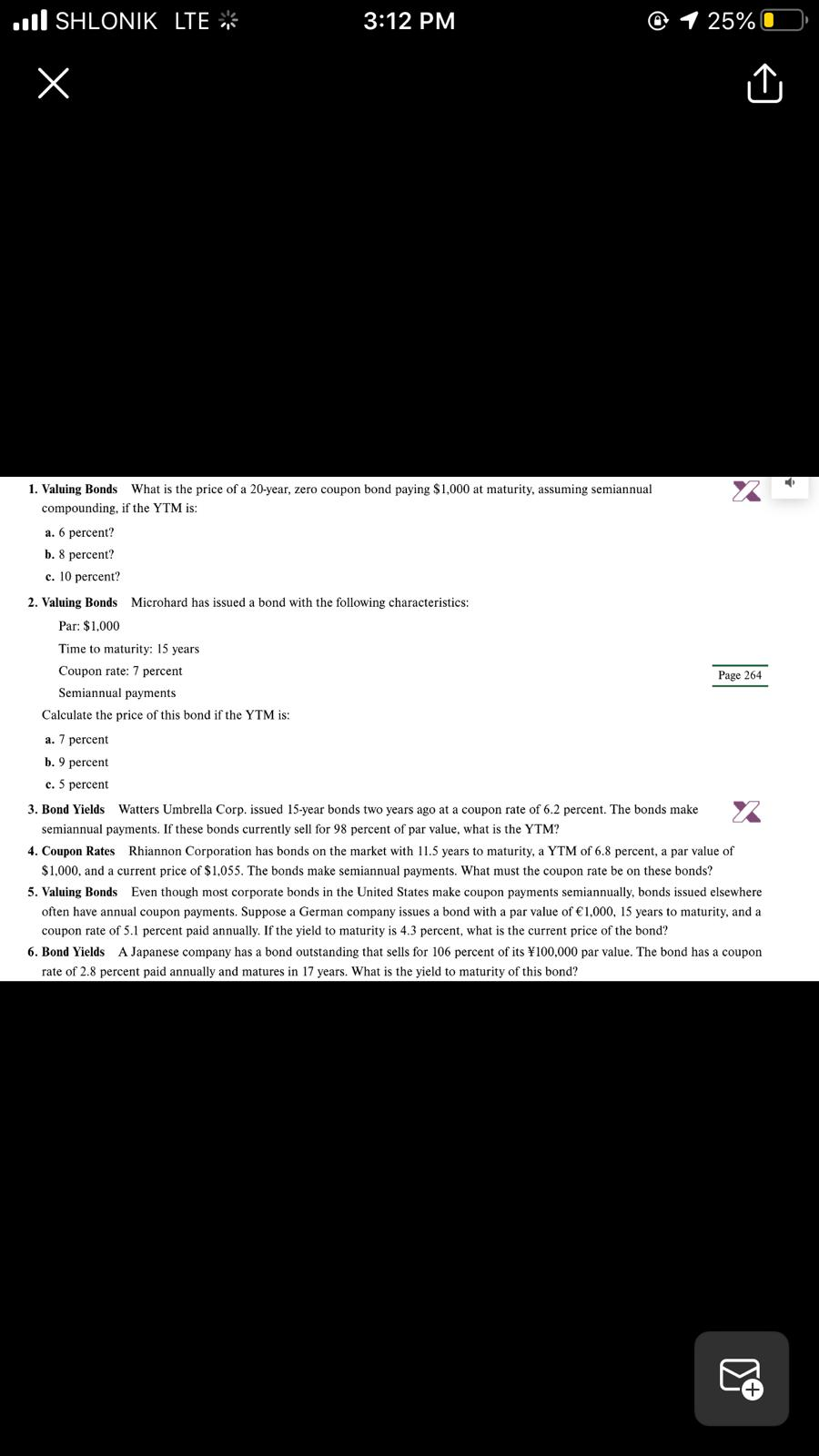

43 valuing zero coupon bonds

en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For...

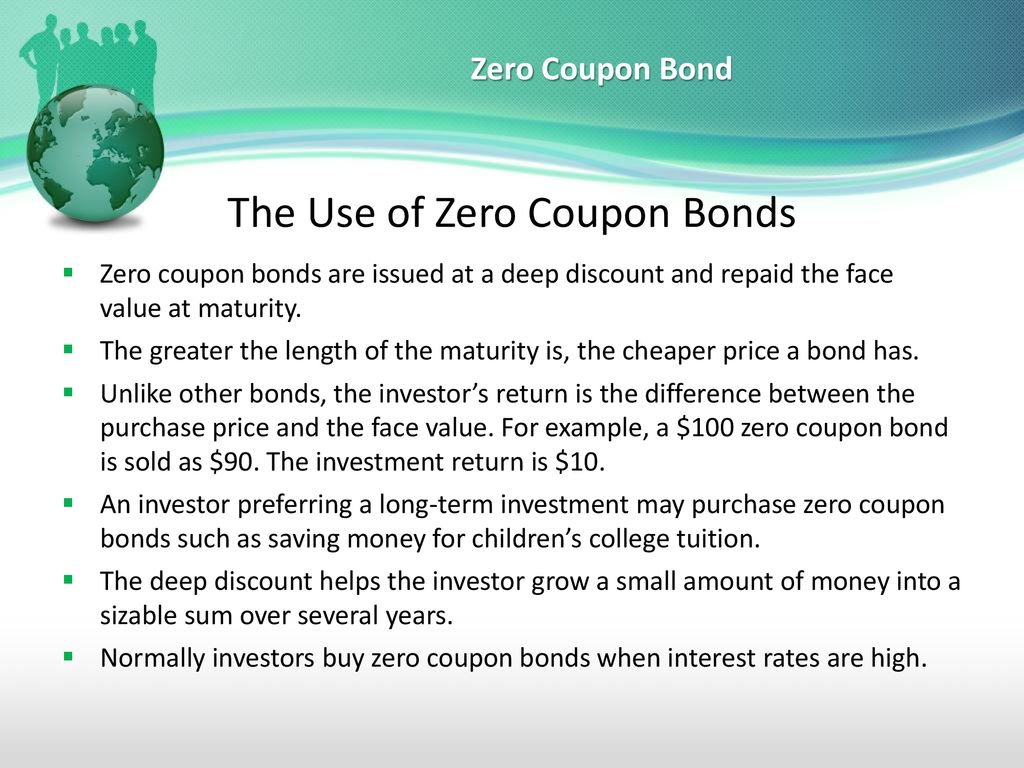

Valuing Zero-Coupon Bonds A zero-coupon bond is one that does not pay interest over the term of the bond. Instead, the entity will sell the bond at lower than face value. When the bond's term is over, the issuing business will repay the bond at its face value. The bondholder generates a return paying less than what he receives in payment at the end of the bond's term.

Valuing zero coupon bonds

Valuation of Zero-Coupon Bonds - YouTube This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual computations as well as wit... Zero Coupon Bonds Explained (With Examples) - Fervent Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires: quizlet.com › 389988684 › finance-2000-chapter-7Finance 2000 Chapter 7 Valuing Bonds Flashcards | Quizlet you want to compute the value of a 5 year, zero-coupon corporate bond given a market rate of 5.5%. what are your inputs? FV=$1000 (the assumed par value of a corporate bond is $1000)

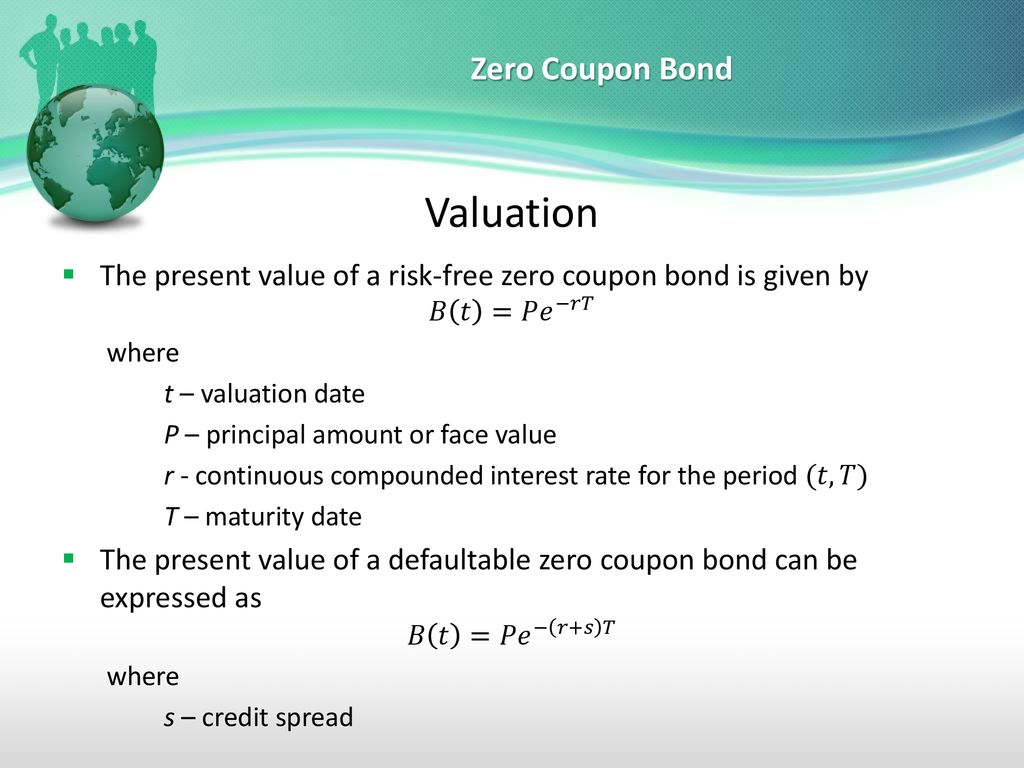

Valuing zero coupon bonds. Answered: A zero-coupon, five-year annual… | bartleby A zero-coupon, five-year annual corporate bond has a par value of $1000. The estimated risk-neutral probability of default for each year is 3%, and the recovery rate is 30%. Assume that the government bond yield curve is flat at 2%, what is the bond price? Zero Coupon Bond - Explained - The Business Professor, LLC Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245. en.wikipedia.org › wiki › FinanceFinance - Wikipedia Personal finance is defined as "the mindful planning of monetary spending and saving, while also considering the possibility of future risk". Personal finance may involve paying for education, financing durable goods such as real estate and cars, buying insurance, investing, and saving for retirement. Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. › what-are-bonds-and-howWhat Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ... What does it mean if a bond has a zero coupon rate? - Investopedia Zero Coupon Bonds. A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A ...

Bond Valuation: Calculation, Definition, Formula, and Example Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... How to Calculate Yield to Maturity of a Zero-Coupon Bond With no coupon payments on zero-coupon bonds, their value is entirely based on the current price compared to face value. As such, when interest rates are falling, prices are positioned to rise ... Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations. Zero-Coupon Bonds and Taxes - Investopedia Long-term zero-coupon bond investors gain the difference between the price they pay for the bond and the amount they receive at the bond's maturity. This amount can be substantial because...

Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Let's take a look at an example of a 5-year zero-coupon bond with a face value of $100. The yield is 5 percent, compounded annually.

Valuing a zero-coupon bond - Mastering Python for Finance - Second ... Valuing a zero-coupon bond. A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows:

en.wikipedia.org › wiki › Outline_of_financeOutline of finance - Wikipedia Corporate finance § Valuing flexibility; Contingent value rights; Business valuation § Option pricing approaches; Balance sheet assets and liabilities warrants and other convertible securities; securities with embedded options such as callable bonds; employee stock options; structured finance investments (funding dependent)

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

en.wikipedia.org › wiki › Financial_economicsFinancial economics - Wikipedia Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade".

› story › moneyUnbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference...

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

quizlet.com › 389988684 › finance-2000-chapter-7Finance 2000 Chapter 7 Valuing Bonds Flashcards | Quizlet you want to compute the value of a 5 year, zero-coupon corporate bond given a market rate of 5.5%. what are your inputs? FV=$1000 (the assumed par value of a corporate bond is $1000)

Zero Coupon Bonds Explained (With Examples) - Fervent Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires:

Valuation of Zero-Coupon Bonds - YouTube This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual computations as well as wit...

Post a Comment for "43 valuing zero coupon bonds"